Investing in Success: The Power of Financial Literacy for Youth

Academic Success | Money Matters | April 25, 2024

April is Financial Literacy Month, a time dedicated to raising awareness about financial education and its positive impacts

At Boys & Girls of St. Lucie County, we recognize that too many young people enter adulthood without the financial education necessary to thrive. According to a recent Fidelity study, 75% of teens aged 13-17 say investing is important to them, but only 23% have actually started.

In many households, the resources and guidance needed to teach crucial money management skills are scarce, leaving young individuals unprepared for the economic challenges ahead. At our Clubs, we understand the importance of empowering young people with financial education, which is why we implement it from an early age.

What is financial literacy?

Financial literacy is more than just a set of skills; it’s the foundation for a life of personal empowerment and stability. It’s about understanding money, how to manage it effectively, and making informed decisions about your finances. This knowledge leads to feelings of safety and empowerment. Those who possess financial literacy tend to experience greater economic success, enabling them to make sound financial decisions that move them forward.

Why Financial Literacy Matters

As young people transition into adulthood—whether heading to college or entering the workforce—they face new and complex financial decisions. Early financial education is key to equipping young people with the necessary tools to navigate these challenges and seize opportunities effectively.

The Power of Financial Literacy

Many need to learn the importance of money, but starting young helps them understand its value and gives them the skills needed to create a foundation for success.

Other benefits of learning financial literacy early include:

- Confidence in Decision-Making: In a survey highlighted by CNBC, 54% of teens say that they are worried about financing their future. In a world where higher education is increasingly linked to career success, understanding how to manage personal finances becomes crucial. This knowledge is not just about earning more; it’s about empowering young people to plan strategically for the life they aspire to lead. This planning often includes navigating options for financing education, such as understanding different loan types and their long-term impacts. By teaching our members about financial principles, we help build their confidence, enabling them to make well-informed decisions about their finances and futures.

- Bridging the Wealth Gap: Educating youth about finances is a step towards diminishing the wealth gap, providing them with the means to build and maintain wealth. Recent trends indicate that many in the Gen-Z demographic are prioritizing immediate spending over long-term savings. This shift highlights the need for financial education that emphasizes the lasting impact and benefits of saving from an early age. Our purpose is to provide our members with the necessary tools to make informed decisions. Not only will it help them understand the significance of financial planning, but it will also prepare them for a thriving future.

- Enhancing Career Opportunities: Financial literacy is more than budgeting and saving, it’s a key contributor to enhanced career opportunities. The decisions our youth make today will set the stage for their future tomorrow. When young people have the financial fundamentals, they are better equipped to navigate the complexities of career choices, negotiate salaries confidently, and assess job offers critically. By fostering financial literacy, we’re not just preparing youth for jobs—we’re preparing them for successful careers.

Our Financial Literacy Programs

At Boys & Girls Clubs, we have two core programs focused on financial literacy.

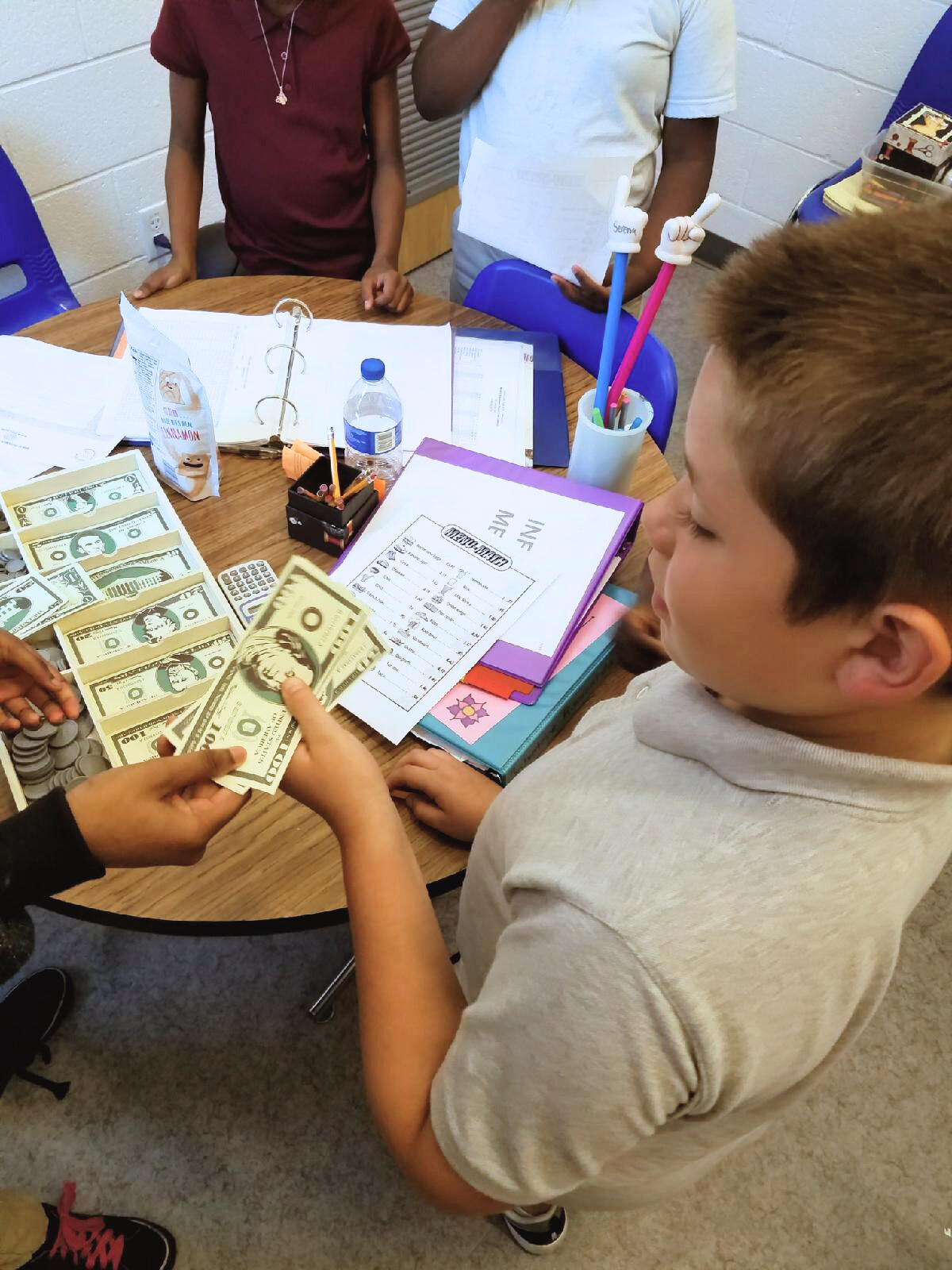

Money Matters

This program introduces members to financial literacy through exercises tailored to different age groups. Starting with foundational money concepts, it gradually introduces more complex topics like checking account management, budgeting, saving, investing, entrepreneurship, and planning for college expenses. Our approach equips members with the knowledge and skills for a secure financial future.

Workforce Readiness

Our program invites our teen Club members to dive deep into personal and professional development. They can earn & learn while gaining the skills they need to set themselves up for future career success. Explore the different ways we’ve empowered our teens through our workforce program to add to their futures that they’re still building today.

The Bottom Line

Learning something new is powerful, and there’s no better time than now to start. At Boys & Girls Clubs of St. Lucie County, we’re committed to equipping our youth with the crucial skills needed to navigate their financial futures confidently.

Through our initiatives, we provide engaging, age-appropriate financial education focused on budgeting, saving, and investing. Our programs are designed to inspire and equip our youth to make smart financial choices that lead to a lifetime of wise decisions.

Parents, we invite you to enroll your child in our financial literacy programs today— every child deserves the chance to build a brighter future. By partnering with us, you’re not just giving your child an education in money management; you’re investing in their growth and confidence.

If you share our vision for a world where every young person can thrive, consider donating. Your investment fuels our programs and helps close the wealth gap, creating a community of knowledgeable, confident young people who are prepared to lead.

Together, we can make a profound impact. Join us in nurturing the leaders of tomorrow through the power of financial literacy.

Related News